SAN FRANCISCO—November 3, 2014— New tax rules from the U.S. Department of the Treasury intended to discourage so-called inversions to avoid U.S. taxation led to the termination of AbbVie’s planned $54.7 billion acquisition of Shire, but it did little to slow the robust M&A activity that has characterized the current year, Burrill Media reported.

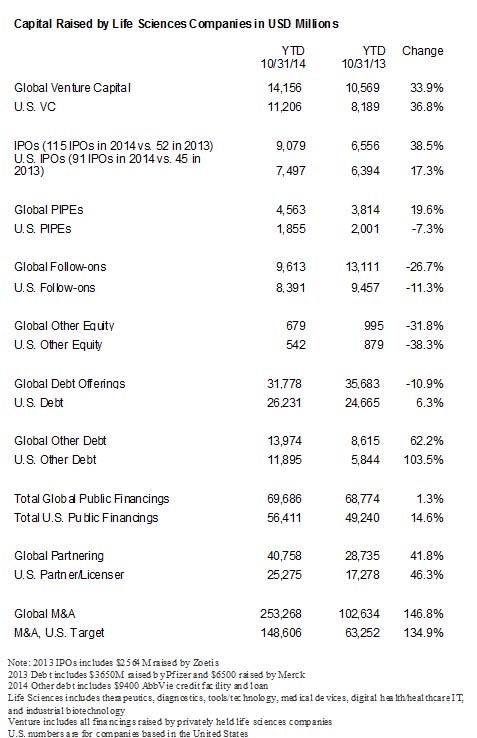

Life sciences companies announced a total of $20.5 billion in M&A transactions in October, up from just $4.8 billion for the same period a year ago. Overall, M&A activity announced through the first ten months of the year reached a revised $253.3 billion, compared to $102.6 billion for the same period a year ago. Burrill Media revised down its total of announced life sciences M&A deals through the first nine months of the year to $231.5 billion from $286.2 billion because of AbbVie’s termination of the Shire acquisition.

In expectation of the termination, Shire’s shares fell 26 percent, its worst trading day in more than 12 years. Shire, though, walked away with a $1.6 billion breakup fee. AbbVie by month-end, bolstered by stronger than expected sales of its blockbuster arthritis drug Humira, said its growth prospects negates the need to make a large acquisition and that it would look to smaller targets.

“AbbVie’s termination of the Shire acquisition is a sign that the new tax rules are having their intended effect,” says G. Steven Burrill, CEO of Burrill Media, which produces publications and conferences focused on the global life sciences industry. “The continued strength of M&A activity suggests that companies are able to see significant opportunities to create value through acquisitions without relying on tax benefits to drive them.”

The brisk pace of IPOs continued in October with a total of 13 life sciences companies completing initial public offerings during the month for a total of nearly $1.3 billion, up from six companies that raised $384 million during the same period the previous year. Most of the activity, though, took place on U.S. exchanges. A total of nine life sciences companies completed IPOs on U.S. exchanges to raise a total of $1.2 billion. Four of those companies completed their offerings below their target ranges. The October IPOs included specialty lab product supplier VWR’s $536 million offering, Danish multiple sclerosis drug developer Forward Pharma’s $220.5 million offering, and the dermitology therapeutics developer Dermira’s $125 million offering. Overall, IPOs completed in 2014 are up an average of 8.6 percent as of the end of October with 42 of those issues trading above their initial offering price and 49 trading below.

“The IPO market continues to show impressive resilience,” says Burrill. “While some companies have needed to temper their expectations to complete their public offerings, we have continued to see an unprecedented number of companies this year complete IPOs, raise record amounts of money, and gain access to public markets.”

The Burrill Select Index rose 6.82 percent in October, outpacing all of the major market indices. Despite the general volatility in the market, the Dow Jones Industrial Average finished the month up 2.04 percent, the S&P 500 rose 2.32 percent, and the Nasdaq Composite Index gained 3.06. Year-to-date, the index Burrill Select Index is up 28.22 percent, well ahead of the gains posted by the major indices.

The strong capital markets continued to fuel venture activity as life sciences companies raised a total of $1.3 billion in private financings globally in October, down 2.7 percent from the same period a year ago. U.S. activity totaled nearly $1.2 billion during the period, a 16 percent increase. Nant Health, healthcare visionary Patrick Soon-Shiong’s integrated healthcare company, expanded its series B round with an additional $170 million in capital, the biggest private financing of the month. That expands the total for the round to $320 million.

Global partnering activity also continued its brisk pace with deal with a total potential value of $5.5 billion announced in October, up from $3.0 billion in 2013. Two of those agreements announced during the month, both centered on cancer immunotherapies, have a potential value in excess of $1 billion. This includes Genentech’s licensing agreement with NewLink Genetics for its early-stage cancer immunotherapy. The deal provides NewLink with a $150 million upfront payment and the potential for up to an additional $1 billion. Separately, Celegene expanded its collaboration with Sutro Biopharmaceutical in a deal that includes an option for the biotech giant to acquire Sutro, a developer of antibody-drug conjugates and bispecific antibodies. The deal over cancer immunotherapies provides a $95 million upfront payment to Sutro and the potential for an additional $1 billion in payments. Overall, global partnering through the first ten months of the year grew to $40.8 billion, up from $28.7 billion during the same period in 2013.

The U.S. Food and Drug Administration’s Center for Drug Evaluation and Research approved five new molecular entities and biologics license applications during October. This included the approval of Gilead’s Harvoni, the first combination therapy approved to treat chronic hepatitis C virus genotype 1 infection. It is also the first HCV regimen that does not require the use of interferon or ribavirin, treatments that require longer periods of use and carry the potential for side effects. Harvoni is a combination of Gilead’s Sovaldi and a new drug developed by Gilead that, like Sovaldi, interferes with the enzymes the virus needs to replicate. Trials showed that after 12 weeks of use, there was no detectable virus in 99 percent of patients. The high price tag for Harvoni is expected to add fuel to efforts from payers and other critics of the cost of specialty drugs to push back against drug prices. As of the end of October, the FDA approved a total of 34 new drugs and biologics. That compares to 20 through the same period a year ago and more than the 27 approved in all of 2013.

Despite the continued strong market for life sciences and the year of record financings, large drugmakers shake-ups at two of the industry’s biggest players took place at the end of October. French drug giant Sanofi dumped its CEO Chris Viehbacher as tensions grew between the CEO and the company’s boards over what was characterized as his lack of communication over such things as an effort to sell a large portfolio of older drugs. Separately, Amgen announced plans to expand layoff already underway with an additional 1,100 job cuts. That raises the total cuts it plans to 4,000. It hopes to reduce expenses by $1.5 billion with the regorganization. The announcement follows calls from hedge fund manager Dan Loeb to break up the company.

“Large drugmakers will continue to face pressure from investors to improve their R&D productivity and show they can deliver new, high-value products to market,” says Burrill. “While Big Pharma may have the worst of its patent cliff behind it, these pressures will only increase for major biotechs as they lose patent protection on top selling products in the years ahead, their piplelines face greater scrutiny, and competition from biosimilars grow.”

About Burrill, LLC

Burrill. LLC is a life sciences/healthcare focused firm focused exclusively on company building, using its almost 50 years of experience capital, network capital, and expertise to help build the next generation of life science leaders. Burrill’s global relationships with healthcare/life science leaders worldwide is without peer, providing Burrill portfolio companies and clients with sustainable competitive advantage.

Burrill Media is Burrill’s information, intelligence, and insight business, publishing weekly, monthly, quarterly and annually developments in the life sciences/healthcare ecosystem. Burrill Media also hosts meetings and events for the life sciences/healthcare industry.

Contact:

Daniel Levine

Levine Media Group

(510) 280-5405

danny@levinemediagroup.com

November 03, 2014

http://www.burrillreport.com/article-abbvie_terminates_shire_acquisition_but_ma_activity_remains_brisk.html